IMARC Group, a leading market research company, has recently released a report titled "Milk Powder Market Report by Product Type (Whole Milk Powder, Skimmed Milk Powder), Function (Emulsification, Foaming, Flavouring, Thickening), Application (Infant Formula, Confectionery, Sports and Nutrition Foods, Bakery Products, Dry Mixes, Fermented Milk Products, Meat Products, and Others), and Region 2025-2033." The study provides a detailed analysis of the industry, including the global milk powder market share, size, trends and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Milk Powder Market Highlights:

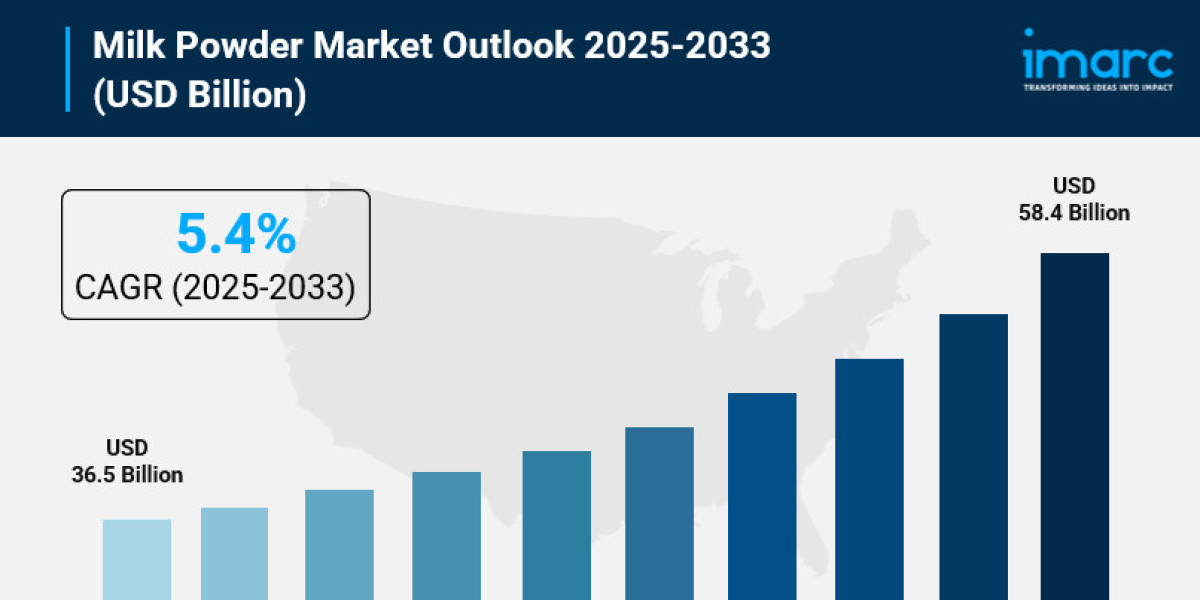

- Milk Powder Market Size: Valued at USD 36.5 Billion in 2024.

- Milk Powder Market Forecast: The market is expected to reach USD 58.4 billion by 2033, growing at an impressive rate of 5.4% annually.

- Market Growth: The milk powder market is experiencing robust growth driven by rising urbanization, expanding infant formula sector, and increasing health consciousness among consumers worldwide.

- Technology Integration: Advanced processing technologies and innovations in fortification are revolutionizing milk powder production, enhancing nutritional profiles and extending shelf life.

- Regional Leadership: The European Union commands the largest market share, driven by established dairy industries and strong export capabilities to global markets.

- Nutritional Focus: Growing awareness of protein-rich diets and dietary supplements is fueling demand for milk powder in sports nutrition and wellness products.

- Key Players: Industry leaders include Arla Foods, Fonterra Co-Operative Group, Nestlé, Danone, Lactalis Ingredients, and Gujarat Cooperative Milk Marketing Federation (Amul), which dominate the market with innovative product offerings.

- Market Challenges: Price volatility in raw milk, maintaining cold chain logistics in emerging markets, and addressing sustainability concerns present ongoing challenges.

Claim Your Free “Milk Powder Market” Insights Sample PDF: https://www.imarcgroup.com/milk-powder-processing-plant/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Explosive Growth in Population and Urbanization:

The world's cities are expanding at an unprecedented pace, fundamentally transforming how people consume dairy products. According to the India Brand Equity Foundation, from January to September 2023, domestic airlines carried 112.86 Million passengers, up 29.10% from 87.42 Million during the previous year—highlighting the rapid urbanization and mobility driving lifestyle changes. Urban consumers, living in smaller spaces and leading busier lives, are increasingly turning to milk powder as a practical alternative to fresh milk. This surge in urban populations is creating enormous demand for convenient, shelf-stable dairy products that don't require refrigeration. Modern consumers expect nutritious options that fit their fast-paced lifestyles, pushing manufacturers to develop high-quality milk powder products that can be stored for months without losing nutritional value or taste.

- Revolutionary Technology Integration and Product Innovation:

Dairy companies worldwide are embracing cutting-edge technologies to transform their production capabilities. Advanced spray-drying techniques, fortification processes, and innovative packaging solutions are setting new industry standards. For instance, in 2024, Saputo optimized its skimmed milk powder grades for easier mixing and reconstitution in warm climates, specifically targeting Latin America, Africa, and Southeast Asia markets. This represents a significant technological advancement that addresses real-world challenges in different geographic regions. Similarly, Nestlé reported organic sales growth of around 4% in 2024, driven partly by innovations in their dairy portfolio. The integration of fortification technologies—adding vitamins, minerals, probiotics, and prebiotics—is transforming milk powder from a basic ingredient into a sophisticated nutritional product that meets specific consumer health goals.

- Massive Government Support and Infrastructure Development:

Governments worldwide are implementing substantial support programs to strengthen dairy infrastructure. India's National Programme for Dairy Development (NPDD), running from 2021-22 to 2025-26, focuses on creating and strengthening infrastructure for quality milk testing equipment and primary chilling facilities. The program supports State Cooperative Dairy Federations, District Cooperative Milk Producers' Unions, and Farmer Producer Organizations across the country. Additionally, the Dairy Processing and Infrastructure Development Fund aims to modernize milk processing plants and value-added product facilities, ensuring dairy cooperatives remain competitive. In Europe, the European Commission provides public intervention support for skimmed milk powder, with provisions for up to 109,000 tonnes of SMP and 50,000 tonnes of butter annually between February and September, helping stabilize markets and protect farmer incomes. These massive government initiatives are creating substantial opportunities for milk powder producers and strengthening supply chains globally.

- Enhanced Nutritional Awareness Driving Demand

Health consciousness is fundamentally reshaping consumer behavior across all demographics. The fitness revolution sweeping both developed and emerging markets has positioned milk powder as a cornerstone ingredient in sports nutrition and dietary supplements. Consumers are actively seeking high-protein, calcium-rich products to support their wellness goals, from muscle building to bone health. Government programs focusing on maternal and child nutrition—such as midday meal schemes and fortified food initiatives—are stimulating institutional demand for milk powder. In regions where cold chain access is limited, particularly rural areas, milk powder provides a reliable and nutritious alternative to fresh milk. The food processing industry's expansion is also contributing significantly, with manufacturers incorporating milk powder into an ever-widening range of products from bakery items to ready-to-eat meals, recognizing its functional properties and nutritional benefits.

Milk Powder Market Report Segmentation:

Breakup by Product Type:

- Whole Milk Powder

- Skimmed Milk Powder

Whole milk powder dominates the market, remaining the preferred choice for consumers seeking richer flavor profiles and higher nutritional content, particularly fat-soluble vitamins and essential fatty acids.

Breakup by Function:

- Emulsification

- Foaming

- Flavouring

- Thickening

Emulsification leads as a critical function, as milk powder serves as a natural emulsifier in processed foods, sauces, and beverages, enhancing texture and stability.

Breakup by Application:

- Infant Formula

- Confectionery

- Sports and Nutrition Foods

- Bakery Products

- Dry Mixes

- Fermented Milk Products

- Meat Products

- Others

Infant formula accounts for the largest application segment, reflecting the critical role milk powder plays in providing essential nutrition to infants worldwide, with manufacturers continuously innovating to match the nutritional profile of breast milk.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

The European Union leads the market, supported by its well-established dairy industries, stringent quality standards, and strong reputation for high-quality exports that are trusted globally.

Who are the key players operating in the industry?

The report covers the major market players including:

- Arla Foods amba

- Dairy Farmers of America, Inc.

- Danone S.A.

- Fonterra Co-Operative Group Limited

- HOCHDORF Swiss Nutrition AG

- Lactalis Ingredients

- Nestlé S.A.

- Olam International Limited

- Royal FrieslandCampina N.V.

- Saputo Inc.

- Schreiber Foods

- Westland Milk Products

- Gujarat Cooperative Milk Marketing Federation (Amul)

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=504&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302